Updated Investment Model

We’ve been operating Indie Fund for over two years now, and much has changed since we started. Two years ago, the digital distribution landscape was much more console-centric, and today there’s a stronger focus on mobile, browser, and PC. Console games now tend to require a higher budget to stand out, yet mobile, browser, and PC games can be developed very quickly on a super small budget. Additionally, our understanding of how to fund projects and work with developers from the investor side has developed significantly.

In order to reflect what we’ve learned in the last couple of years and to better match the current environment, we’ve decided to adjust our funding terms, and we would like to share our thoughts and motivations around this. There are two major reasons behind this change. First, we want to invest in a wider range of projects, both smaller and larger. Second, we want to take bigger risks with projects that push the medium in new directions, and this often comes at the expense of commercial potential. We will discuss both in more detail, but before we go there, let’s compare the old and new investment terms.

The Old Terms

Under the old terms, a project was approved for funding up to a certain amount. As an illustration, let’s say $100k. Once that project is released, the first $100k go directly to Indie Fund, and for two years after the $100k is repaid, Indie Fund gets 1% for every $10k that the developer was given. So if the developer received $100k from Indie Fund, they pay 10% of the game’s revenue for two years after Indie Fund recoups the initial $100k. The agreement expires 3 years after the initial release, or 2 years after Indie Fund recoups, whichever is sooner. At that point, if the investment hasn’t been paid back in full, it is forgiven, and the developer is free to move on.

The New Terms

Similarly to the old terms, a project is approved for funding for a specific amount, Indie Fund first recoups 100% of the loan, and then receives a revenue share for a limited time. However, instead of having a variable revenue share based on the amount invested, Indie Fund is paid a fixed 25% until we double our investment or until 2 years have passed since the game’s release. Let’s consider a $100k project as an example: Indie Fund would get the first $100k the game earns, and then collect 25% of the revenue until the game has earned a total of $500k. At that point Indie Fund will have been repaid the $100k investment and made another $100k on top of that, while the developer would have earned $300k and keep everything the game earns from there on out. As mentioned above, the agreement expires 2 years after the game’s release, and if the loan had not been repaid by that time, it is forgiven. If you’re interested in the specifics, our new funding agreement is publicly available here. Now let’s go into more detail about the two motivations for this change and see how the new terms allow us to invest in both smaller and larger projects as well as to invest in riskier projects.

Investing In Smaller And Larger Projects

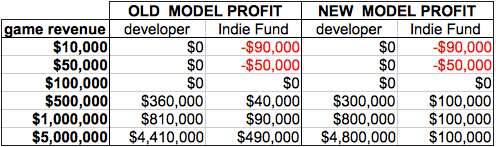

As a starting point, let’s examine what happens with a $100k project, which is a typical investment for us right now:

For anything the game earns up to the investment amount of $100k, the outcome is the same with both the old and the new terms. With the new terms, if the game makes a profit, Indie Fund makes a profit quicker than before, and we also get out quicker than before, allowing the developer to keep more of the money if the game does really well. If a game like this does “OK” and makes $500k, the developer would make $360k in profit with the old terms and $300k in profit with the new terms. It’s a significant difference, but not nearly enough of a difference to matter in the developer’s ability to self fund future projects. But what happens when these terms are applied to a smaller, $10k project?

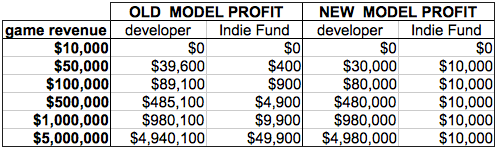

If you take a look at how much profit Indie Fund makes on a $10k investment with the old terms, you’ll notice that unless the game makes hundreds of thousands of dollars (which is statistically rare for projects of this size) it’s not a very good investment of time and money for us. Our expected return on investment in such projects is miniscule, yet the risk of taking a loss is not insignificant. Many mobile games end up earning less than $10k. Yet there are projects that can hugely benefit from smaller investments. Steph Thirion’s FARAWAY, for example, needed $20k in finishing funds. We approved it because we think it’s a great game and we wanted to help ensure Steph remains self-fund and creates more amazing titles. But with our post-recoup revenue share being 2%, our upside is very limited. Our goal is to grow the fund and invest in more developers, and even if FARAWAY is a big hit and earns a million dollars in the first two years, it will not have a significant effect on our balance sheet.

If we move to the other extreme and look at what happens with $500k projects -- which we don’t have enough money to fund right now, but hope to be able to fund in the future -- we notice that the old terms are starting to smell like a shitty publishing deal. Indie Fund would end up taking half of the profits, so that would definitely not work:

For million dollar projects our old terms completely break down, as 1% for each $10k of investment would mean we take 100% of the profits. The new terms, however, scale nicely and works for projects of any size, allowing Indie Fund to generate a profit without hindering the developer of a successful game from becoming sustainably self funded.

Investing In Riskier Projects

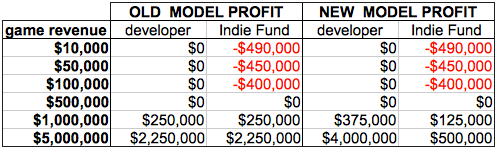

With the old terms, it’s very difficult to recover from a cancelled project. Take Shadow Physics, for example. We put $90k into that project before we ceased funding it and the project was put on hold, so we’re now $90k in the red. It would take one of our $100k investments to make a million dollars within 2 years of launch in order for us to make up for that loss. We believe there’s a very reasonable chance that at least one of the games we’re funding will do that, but it’s certainly not guaranteed.

The old terms encourage us to stay away from risky projects and to try to focus on finding hits. This is not the direction we want Indie Fund to go. Hypothetically speaking, if we did want to take this route, it’s a very poor startegy all the same, as it’s all but impossible to spot the big hits ahead of time. Who could have guessed that Minecraft would become the most financially successful independent game of all time? Or that Castle Crashers, Limbo, World of Goo, or Braid would have done as well as they did?

The new terms allow us to grow Indie Fund with games that do “just ok” financially without requiring a hit to make up for projects that generate a loss. We can then fund more long shots, knowing that we’d be ok if they fail as long as we have another game do “just ok” in terms of sales.

This is about the long and short of it. If you have any questions, leave them in the comments section below, we’d be happy to discuss this further.

It’s also worth noting that this shift in funding terms is part of a bigger plan for the evolution of Indie Fund, and we hope to share further news about this in the not too distant future.